The Merge has been perhaps the most important development to the Ethereum network since its inception in 2015. What will its impact be upon the NFT space in the future?

The Environmental Impact

Broadly speaking, the Ethereum Merge was the transition of the Ethereum network from the use of a Proof of Work (PoW) protocol to one using Proof of Stake (PoS). The transition to a PoS network offers many benefits, the primary one being a huge reduction in Carbon emissions.

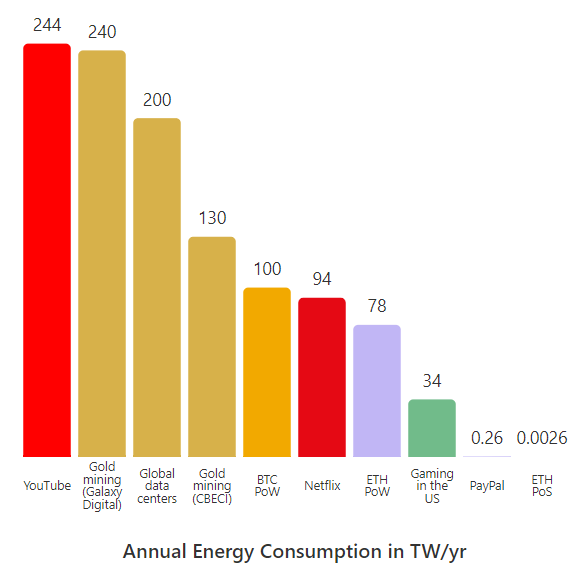

One of the main criticisms of Ethereum (and still a criticism of Bitcoin) was the amount of energy needed to run the network. Thankfully, The Merge changed this and it’s estimated that Ethereum’s CO2 emissions have been reduced by about 99.99% since The Merge. This is equivalent to a 0.2% drop in annual global electricity consumption.

The Ethereum network now uses around just 2,600 megawatt-hours per year compared to the 23 million it did before The Merge. This is roughly equivalent to running a standard laptop for each of the roughly 7,500 nodes in the network.

How Ethereum’s electricity consumption now compares to some other famous energy guzzlers. The estimates of gold mining’s energy consumption vary by source.

How Ethereum’s electricity consumption now compares to some other famous energy guzzlers. The estimates of gold mining’s energy consumption vary by source.

Initial Impact of Merge on NFTs

Perhaps ironically, September of 2022, the month The Merge took place, actually turned out to be one of the worst months for NFT sales.

The Merge’s initial impact on the NFT market was muted. Trading decreased in the run-up to The Merge and in the week after was only slightly better. According to DappRadar, $84 million worth of NFTs was traded in the week after The Merge, a 5% increase on the prior week. The average price of NFTs sold however fell 15%, to $199.

The lack of a surge in NFT sales came as somewhat of a surprise to many in the community. Most believed that the transition to proof of stake would lure in environmentally-minded traders who were concerned about Ethereum’s energy consumption.

Prior to The Merge, some were worried about possible attacks on the network and theft of digital assets stored on it. Thankfully this didn’t happen and everything in terms of asset ownership has remained as it was prior to the upgrade. Yet still, there was no huge uptick in sales volumes.

Thankfully most users are focussing on The Merge’s long-term impacts, and as with many of the projects in the world of Web 3.0, the impacts have only just begun.

Potential Future Impacts

Sharding

The Merge paves the way for future Ethereum upgrades, one of which is sharding. This involves splitting the Ethereum blockchain up into smaller and more manageable segments. It will allow blocks to be processed in parallel and increase block space on the Ethereum network.

Not only does this reduce the amount of computation needed to validate the network, it also makes it vastly more scaleable. Arguably its most important impact upon the NFT world however will be a reduction in gas fees.

Gas fees have been a huge problem in the Ethereum and NFT space. People are obviously reluctant to pay $200 in gas fees when they’re only paying $100 for an NFT. Reducing gas fees to a more manageable level is key if Ethereum is to fulfill its potential and become the world’s computer.

The sharding upgrade is expected to take place in 2023 in an event known as “The Surge”, and will reduce gas fees to a more manageable level. It will also increase the transactions per second possible on the network from around 30 to roughly 100,000.

Wider Adoption

With the reduction in CO2 emissions comes the potential for wider adoption and more mainstream use of the Ethereum network and NFTs. One of the main criticisms of cryptocurrencies in recent years has been their impact upon the environment. Now that this is no longer a concern for users of Ethereum, more people will likely start to enter the space.

Prior to The Merge, given Ethereum’s huge energy consumption, some artists felt like using Tezos to mint NFTs was their only option. Tezos’s PoS protocol allowed it to grow to become one of the world’s most popular NFT blockchains. In China, where the government is notoriously critical of the crypto and NFT movements, Tezos was one of just 6 blockchains to be integrated with the country’s state-backed blockchain network (BSN).

When Ethereum was using PoW, Tezos allowed artists to use a chain that was cheaper, faster, and less damaging to the environment. This is the primary reason NFT sales volume on the Tezos network grew for 6 consecutive quarters from the start of 2021 to Q3 2022. Now that Ethereum uses PoS however, whether this growth will continue is unclear.

Differences still exist between the 2 and there are reasons why one may prefer using Tezos over Ethereum even now. However, the main reason artists had for using Tezos (concerns over Ethereum’s environmental impact) has vanished, and many will switch over to Ethereum given its community and much larger addressable market. How this will impact other blockchains will be interesting.

The Impact on Other Blockchains

Now that the environmental concerns of NFT users have been alleviated, what are the advantages of using other blockchains given Ethereum’s popularity and massive community?

Solana’s speed is still a major selling point when it comes to comparisons with Ethereum. If the Surge does raise the transactions per second on Ethereum to ~100,000, then this advantage will become obsolete. Until then the Solana network remains much quicker than the Ethereum one.

Unfortunately for users of the Solana ecosystem, the community is nowhere near as big as Ethereum’s. There are some notable NFT marketplaces that use Solana such as Magic Eden, but there are far fewer buyers and sellers than on Ethereum marketplaces like OpenSea or Rarible.

Tezos has the ability to self-amend without the need for hard forks. It can self-improve through a formalized protocol upgrade process. Tezos’s lower transaction fees when compared to Ethereum, still give it an advantage in some aspects when it comes to NFT development.

Again, arguably the main advantage of Ethereum over Tezos is the network effects it already has because of its massive community. This is an incredibly difficult problem to overcome (as many social networks have discovered when trying to challenge Facebook), and it’s unlikely that any other blockchain will do so in the near future.

There are innumerable blockchains nowadays but it seems very unlikely any of them will become more popular than Ethereum for NFT development.

There are innumerable blockchains nowadays but it seems very unlikely any of them will become more popular than Ethereum for NFT development.

Takeaway

Until now the main impact of The Merge has been the reduction in CO2 emissions. This is undoubtedly important and opens the door for increased investment from the ESG (Environmental, Social, Governance) investing community, as well as other institutional investors.

Most of the Web 3.0 community however, see The Merge as just the next step in the completion of Ethereum’s ultimate goal of becoming the world’s computer. Vitalik has said the project is still only 55% finished.

It’s going to be amazing to see what the 2020s hold for Ethereum and NFTs but the first of the major upgrades for the network was completed successfully. The road is now clear for further upgrades over the next few years and the further development of Ethereum and the NFT ecosystem.

Get more insights like this on the business and marketing of the metaverse delivered to your inbox. We’ll never spam you, ever.

Harry Harrison

After spending 3 years traveling around Australia and Asia I began writing about finance whilst stuck at home at the beginning of 2020 thanks to Covid. I've always had a strong interest in business and technology and he thoroughly enjoys learning more about anything connected to the Metaverse, NFTs or crypto. In my spare time he enjoys playing soccer, pool or chess and reading about history, science and technology.

Related Posts

December 8, 2022

Overview of NFT Use in the Music Industry

NFTs are a new technology set to revolutionize many old industries. One of…

December 1, 2022

How The SEC Might Regulate NFTs

The Securities and Exchange Commission (SEC) has taken a somewhat critical view…

October 11, 2022

Unstoppable Domains VS Ethereum Name Service

Unstoppable Domains (UD) and the Ethereum Name Service (ENS) are both used to…